One of the fastest-growing economies

In South-East Asia

Why should I invest in Vietnam?

Vietnam's GDP has been growing at an impressive rate over the last decade, positioning the country as one of the fastest developing economies in the world. This positive trend allowed Vietnam to become a middle-income country with a population of nearly 100 million people, placing it as one of the most populated countries among the Southeast Asian nations. Moreover, from a geographical perspective, Vietnam surely benefits from being a close neighbour of China the world’s largest manufacturing country.

As average wages keep increasing in China, Vietnam becomes the natural substitute country for those companies seeking lower costs of production while simultaneously securing proximity to China’s supply chain and logistic infrastructure.

The government’s initiative to further develop the country as an attractive investment hub also turned out to be successful, with foreign companies feeling more confident to set up operating centres in Vietnam. Reforms have resulted into a partial privatisation of state-owned enterprises, liberalisation of the trade regime, and into an increased recognition of private property rights. In essence, a gradual integration into the global trade and investment scene allowed Vietnam to transform itself over the years into a more market-oriented economy.

The key industry sectors of the Vietnamese economy are textile, electronics, food & beverage, furniture, plastic materials, tourism and IT/telecommunication. In terms of Foireign Direct Investment (FDI), Vietnam remains one of the most attractive locations for foreign investors in South East Asia. FDI inflows have seen a steady and strong increase. The main investors in Vietnam are Korea, Japan, China, Singapore and Hong Kong. The United States is Vietnam’s largest export market with a relevant turnover.

How can I set up a Company in Vietnam?

Limited Liability Company

A limited liability company is a legal entity established by capital contribution from its members which is treated as equity (or charter capital). A limited liability company is not allowed to issue shares. The total number of members in a limited liability company is restricted to 50.

A liability company may be established by foreign investors in either one of the two following forms:

1° - A 100% foreign-owned enterprise (where all members are foreign investors) or

2° - A foreign-invested join-venture enterprise with at least one domestic investor

Joint-stock company

A joint-stock company is a legal entity established by its founding shareholders on the basis of their subscription of shares of the joint-stock company. The charter capital of a joint stock company is divided into shares and each founding shareholder holds a number of shares corresponding to their subscribed and paid-up shares in the joint stock company.

A joint-stock company is required to have at least three shareholders (with no maximum number of shareholders). A joint- stock company may take the form of either (cf. 1° LIMITED LIABILITY COMPANY) 100% foreign- owned; or (cf. 2° LIMITED LIABILITY COMPANY) a joint venture between foreign and domestic investors.

Branch

A foreign company may set up a branch office in Vietnam.

This form of foreign direct investment is only permitted in a few sectors (e.g. banking, education or law firms).

A branch is a part of a foreign company that does not have its own legal personality, although it is permitted to conduct business activities in Vietnam. The head office is fully liable for the activities of its branch.

Representative Office

A foreign company also may set up a representative office (RO). A representative office may not engage in any commercial activities and does not have the status of a separate legal entity. It may carry out marketing and promotional activities for the head office, act as a liaison office and/or import goods for marketing and promotion.

Set up Procedures

Company set up procedures

01

Location Selection

02

IRC + IERC Application

Representative Office set up procedures

01

Location Selection

02

RO/Branch Application

03

Seal&Taxcode Application

Tax framework in Vietnam

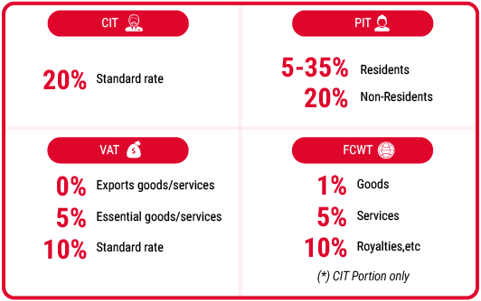

The Vietnamese tax system is comprised of the followings:

- Corporate Income Tax (CIT)

- Personal Income Tax (PIT)

- Value Added Tax (VAT)

- Foreign Contractor Withholding Tax (FCWT); and

- Others (i.e. Special Sales Tax, Import & Export Duties Natural Resources Tax, Property Taxes, Environment Protection Tax, Business License Duty & Registration fee)

Disclaimer: illustrative; percentages based on latest applicable regulation at the time of publishing; information provided do not substitute professional advice from our consultants.

Employment

How can I employ staff within my company in Vietnam?

As a member of WTO and FTA being initiated Vietnam is in urgent domestic and international demand for the incorporation and implementation of international labour

standards. Protection wise there is no distinction between foreigners with a local labour contract and Vietnamese employees. Indeed, the general rule is, that foreigners working in Vietnam must comply with Vietnamese Labour Law.

There are two types of labor contracts for Vietnamese employees: an indefinite-term LC and a definite-term LC with a duration not exceeding 36 months.

How can I onboard foreign staff in my Vietnamese company?

All foreign individuals require a Work Permit/ Work Permit Exemption Certificate issued by the Department of Labour, Invalids and Social Affairs (DOLISA) in order to undertake any employment in Vietnam.

Work permits are issued for a maximum period of 2 years and may be renewed if certain conditions are met.

How much does an employee cost?

Disclaimer: illustrative; percentages based on latest applicable regulation at the time of publishing; information provided do not substitute professional advice from our consultants.

Operations & Locations

How can I finance my operations?

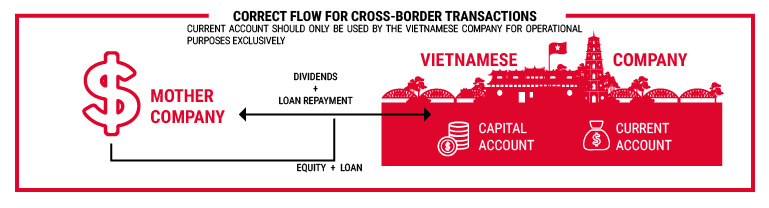

Cross-border financial transactions between foreign-invested companies (FICs) in Vietnam and foreign entities are strictly regulated by the State Bank of Vietnam (SBV).

FICs must register the total investment capital (equity capital + debt capital) on the Investment Certificate and the Investment Registration Certificate before the entity gets incorporated.

The equity capital has to be paid up within 90 days after company establishment. After the FIC has audited its yearly financial statements, dividends can be distributed back to the foreign mother company.

Concerning foreign loans, limitations are defined at the time the FIC is established. Medium- and long-term loans must be registered with the SBV; if the registered amount exceeds the registered total investment capital, the registration will be rejected.

Usually, cross-borders transactions take place by way of foreign entities (lenders) providing loans to FICs in Vietnam (borrowers), due to high interest’s rate for financing provided by local banks.

It is known that existing FICs in Vietnam have often made misuse of capital and current accounts while receiving and repaying offshore loans and dividends.

How can I find the correct location for my investment?

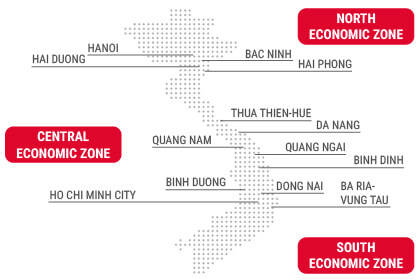

In Vietnam you can find Industrial Parks (IPs), Economic Zones (EZs) and Export Processing Zones (EPZs). Since the implementation of the Đổi Mới (economic rejuvenation) policy in 1986, the government of Vietnam has been encouraging foreign investments into the country by creating favourable legal environment and infrastructure.

Industrial Parks (IPs), Economic Zones (EZs) and Export Processing Zones (EPZs) have made an essential contribution to attracting investment, creating jobs and improving the economic growth of Vietnam for the past 32 years.

Choosing a suitable Industrial Park

To guarantee competitiveness and secure production within a work friendly environment, it is crucial to choose your Industrial Park well. Here are the main economic zones in Vietnam.

Northern Key Economic Zone

The economic triangle of Hanoi – Hai Phong – Quang Ninh is one of the key economic zones of the country. Computers, Electronic and Optical Products’ are the most common occupiers with 25%, then there are ‘Machinery and Equipment with 15% and ‘Fabricated metal Product’ with 12%.

Central Key Economic Zone

The economic zone in the central area is considered to be at the infancy stage, but Da Nang has been known as one of the top tourist cities in Vietnam with an infrastructure and transportation system and a port that are giving benefits to the industrial and commercial activities.

Southern Key Economic Zone

The Southern Key Economic Zone is leading the industrial development of the whole country.

The majority of the industrial parks were developed by local groups of developers with reputable names such as Becamex IDC, Sonadezi and Vietnam Rubber Group. The key occupiers by sectors in the area are ‘Machinery and Equipment’, ‘Textile and Apparel’, ‘Fabricated Metal Product’, ‘Rubber and Plastic’ .