- Home

- Fidinam and partners

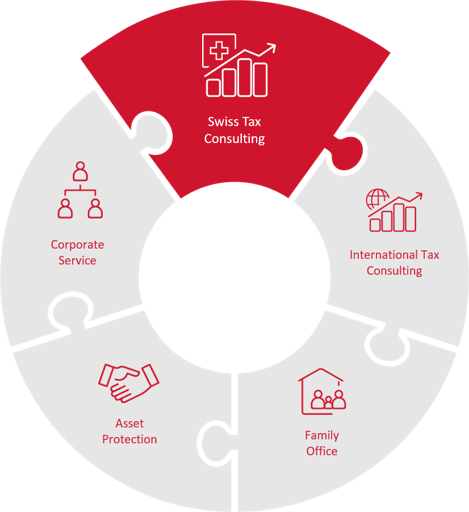

- Swiss tax consulting

At your side

Our in-depth knowledge of Swiss taxation allows us to assist you with the preparation of opinions and feasibility studies, the preparation of tax returns and related forms, right up to tax litigation. Our team of experts on Swiss tax issues can guide you in your choices, both personal and corporate. From the incorporation and domiciliation of companies to tax assistance in the event of extraordinary corporate transactions: we can assist you right across the board.

Our in-depth knowledge of domestic and international taxation in the countries in which we are based allows us to assist you with the preparation of opinions and feasibility studies, the preparation of tax returns and related forms, through to tax litigation.

Preparation of tax declarations for individuals and legal entities

Tax planning opinions and feasibility studies

Relocation services

We advise clients on the delicate matter of handling tax disputes and reaching agreement with the tax authorities by applying appropriate dispute resolution processes . We serve a wide range of clients, including multinational corporations, entrepreneurs, high net worth individuals, trusts and often other advisors, whether lawyers or accountants. We are particularly well suited to assist Swiss and international companies facing major global tax disputes involving numerous countries, tax regimes and dispute resolution processes.

Strategic and tax planning of tax assessments and disputes

Tax risk management

Tax litigation

Ensuring that your company is not only compliant with regulations, but also as tax efficient as possible is an ongoing challenge. Our experienced consultants can support you with targeted, specialist advice on corporate taxation, business taxation and tax strategies for companies. Thanks to our international network, we can resolve tax issues quickly and efficiently wherever they arise, regardless of company size.

Business internationalisation consulting

Direct taxation

VAT

The growing demand for transnational intra-group transactions makes it essential to manage transfer pricing correctly. The Fidinam Group , through its experts based in more than 10 countries, guarantees its clients a correct management of transfer pricing in compliance with international rules. We support international companies in managing their risk by aligning their transfer pricing policies with their global business objectives and operations.

Transfer pricing preparation

Preparation of transfer pricing documentation

Risk management assistance

Any corporate intermediation - sale, merger or acquisition - can have significant tax impacts for the company. With more than 60 years of experience, we have acquired the expertise and ability to support our clients at every stage of the M&A tax process, from the buyer's or seller's perspective.

Specifically, we can offer the following services:

Tax due diligence

Specialist tax opinions in corporate reorganisations

Tax litigation arising from the acquisition or sale of the company

Tax structuring following the acquisition and sale of the company

Fidinam's interdisciplinary team of consultants, with their broad range of profiles and years of experience, has been able to develop extensive knowledge in different areas of taxation such as the establishment and management of private equity structures, commodity trading, coordination of tax aspects of extraordinary corporate finance transactions.

Creation and management of private equity structures

Creation and management of commodity trading structures

Tax and legal advice for extraordinary finance transactions

No Data Found

All content © . All Rights Reserved.